The grassroots movement to eliminate property taxes in Pennsylvania

Image by Guillaume Federighi

David Baldinger is eating a slice of pizza inside an Italian restaurant outside of Reading when his cellphone rings. The balding, 70-year-old cancer survivor’s eyes light up as he listens to the voice on the other end. It’s state House Majority Leader Dave Reed’s office. They’d like to set up a meeting, please.

Baldinger, a retired radio and TV producer, is quick to animation and articulation in a way that belies his age, but nothing outwardly differentiates him from any other guy in the pizza shop. His phone’s caller ID is the only indication that he leads Pennsylvania’s most powerful grassroots anti-tax coalition and is the public face of a legislative push to make it the first state to abolish property taxes.

“There’s no such thing as property tax reform; there is no such thing as property tax relief,” he said. “It’s the only tax we have that isn’t based on your ability to pay. We just need to get rid of it.”

His group, the Pennsylvania Taxpayers Cyber Coalition, and its mission to eliminate the state’s largest source of school funding, once elicited eye rolls in Harrisburg when they first began lobbying legislators 13 years ago. Today, politicians are calling him – a testament to his group’s organizing and advocacy, he said. Baldinger believes his organization is on the cusp of a great victory.

“If it’s going to happen, it’s going to happen in 2017 – the system has just gotten out of hand,” he said in a deep voice that harkens back to his days in Philadelphia-area radio. “The media doesn’t want to talk about it, but people want it.”

The “it” is House Bill 76 and Senate Bill 76, legislation Baldinger frequently refers to as “our bill” and for which he takes personal credit for co-authoring. It’s a sweeping proposal that would eliminate more than $14 billion in school property taxes, replacing that revenue by increasing the state income tax to 4.95 percent and the state sales tax to 7 percent – 61 percent and 17 percent increases, respectively.

To hear Baldinger tell it, the shift will transform Pennsylvania into an economic Xanadu, reversing years of population decline and job losses in many parts of the state, while unburdening homeowners buffeted by constant property tax increases. The state will actually collect more tax revenue in the long run, tax abolitionists like Baldinger say, by abandoning a system he describes as antiquated and regressive.

As Baldinger puts it, the legislation would “turn the whole state into a Keystone Opportunity Zone” – a reference to geographically-specific tax breaks meted out by the state.

Across the table from Baldinger sit the heads of two allied organizations: Ron Boltz, a burly, crewcut electronic technician who heads Pennsylvania Liberty Alliance, and Jim and Sue Rodkey, the husband-and-wife team behind The Lebanon 9-12 Project. Boltz said that while conservative groups like his have helped propel SB 76 forward, property tax elimination is a bipartisan issue.

“The studies show that it's going to be economically prosperous for you whether you’re a Republican, a Democrat or a Libertarian,” he said. “This bill will treat every single taxpayer exactly the same way. It’s no longer going to be based on your ZIP code.”

For those unfamiliar with the movement, this talk often seems like exactly that: tableside chatter about a proposal too radical to ever be taken seriously. Indeed, for years, PTCC was mostly humored by many legislators. Receptive members such as state Sen. Dave Argall, state Rep. Jim Cox and former state Rep. Sam Rohrer were in the minority.

Later, after Baldinger has finished his lunch and left his compatriots behind, he drives back home in a pickup truck marked with two SB 76 stickers on the tailgate. Standing in his driveway in the frigid January weather, he reflects on his battle with lung cancer. He survived the disease, but during his darkest moments, he was forced to put the Rodkeys in charge of the PTCC and watch the 2015 SB 76 vote from a hospital bed.

“This is what keeps me alive now,” Baldinger said.

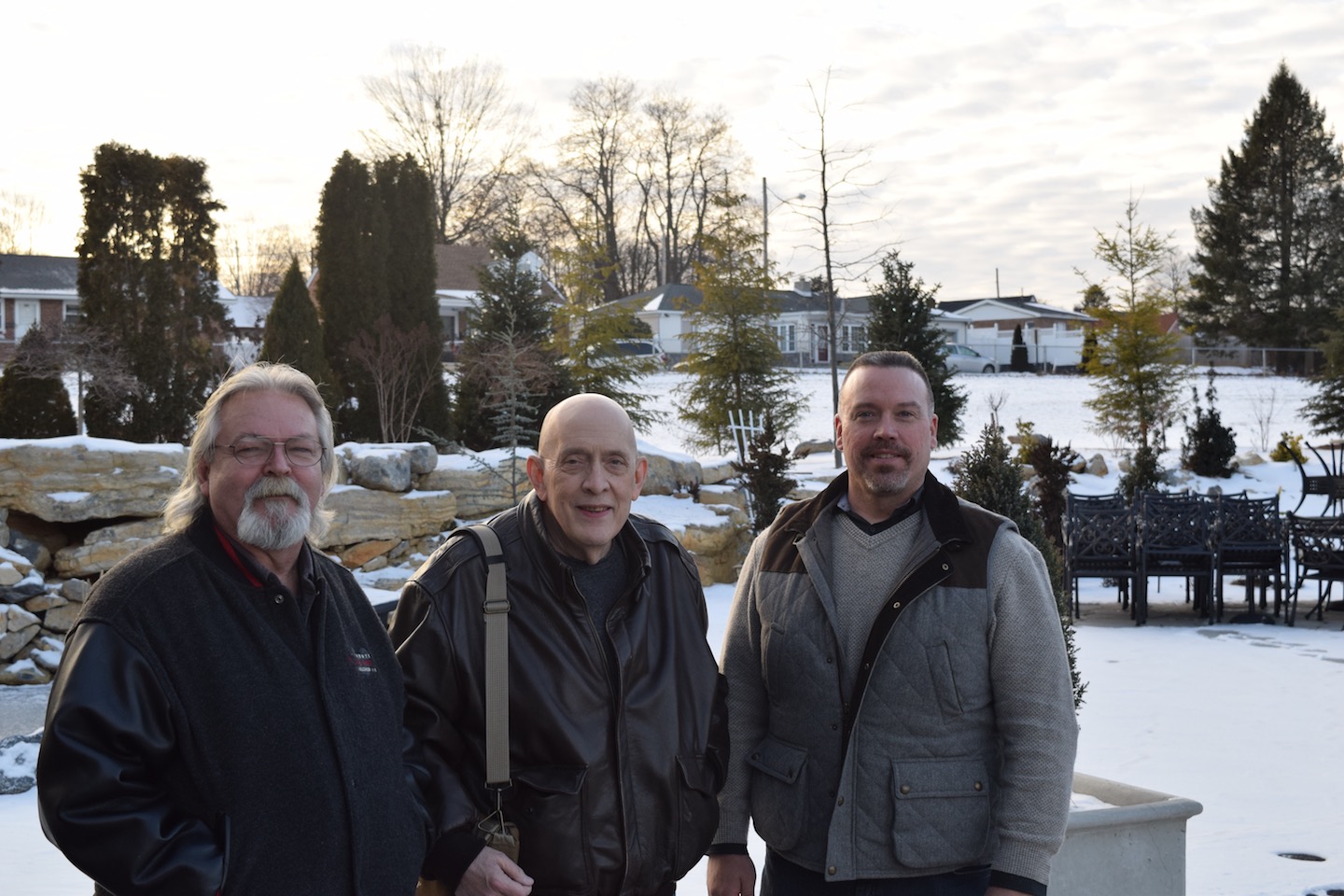

Jim Rodkey of the Lebanon 9-12 Project, David Baldinger of The Pennsylvania Taxpayers Cyber Coalition and Ron Boltz of the Pennsylvania Liberty Alliance. Photo by Ryan Briggs

In late 2015, despite vicious opposition from school administrators, the state Senate unexpectedly tied a vote on SB 76. In a kind of precursor to President Donald Trump’s populist surge, tax abolitionists said most of the political elite were too disconnected from ordinary people to know just how ready many homeowners were ready to burn down the current system. “This bill is exactly what people want. They don’t want their property taxes reformed; they want them gone,” said Argall, for whom reintroducing SB 76 is a top priority. “If you go to Indiana County or Berks County, it’s a huge issue. I can’t sit down at a lunch counter to buy a hamburger without someone asking me about property taxes.”

The 2015 measure failed after a tiebreaking vote cast by Lt. Gov. Mike Stack, garnering limited press amid a larger, long-stalled state budget fight. Opponents of SB 76 comforted themselves with the knowledge that the bill wouldn’t have cleared the House due to fierce opposition from Speaker Mike Turzai or gotten a signature from Gov. Tom Wolf anyway.

But Baldinger and coalition supporters were jubilant. They were one vote away from getting their bill through the Senate. The eyes had finally stopped rolling.

That was in 2015. Suffice it to say, a lot has changed since then. Voters just sent a raft of new Republican senators to Harrisburg – the PTCC takes direct credit for knocking out incumbent Sen. Rob Teplitz – all of whom ran on platforms that included slashing property taxes. By many accounts, Wolf is weaker than ever, and advocates think he’s too concerned with his impending re-election fight to bet his career on vetoing their bill.

There’s a good chance they’re right: Earlier this month, the governor’s office sent City & State a statement for this article that read, in part, that Wolf “could support taking steps towards elimination.” Just a week later, the governor told Philadelphia Inquirer business columnist Joe DiStefano, “I am for elimination of the property tax.”

The messaging is significant, although in both statements Wolf was quick to note that he had “serious problems” with the specifics of how SB 76 was currently written. Details have always been the flaw at the heart of the PTCC’s 13-year mission to pass SB 76, which is a necessarily complex piece of legislation.

Property taxes are unpopular, but even with concessions in the current bill designed to make it more politically palatable, the bill calls for sweeping tax hikes that many Pennsylvanians may not yet fully understand. While eliminating nearly all property taxes would surely have upsides – increased property values and direct tax relief for certain overburdened homeowners – there are likely to be unknown side effects of such a sweeping bill.

“This will shift the tax burden from homeowners to other segments of the population. It may hit some segments of the population very hard, particularly people with kids in school,” said Mark DiRocco, executive director of the Pennsylvania Association of School Administrators, one of the bill’s biggest opponents. “If you have five kids and are paying more in sales tax, plus your earned income tax goes up, you’re hitting the very people schools are serving,” he said.

PASA has good reason to be opposed to the bill – it would overturn one of the most stable school funding streams and make a sometimes hostile state Legislature entirely responsible for distributing educational funding. While the bill would be a step toward ending unequal funding between rich and poor school districts – long a goal of educational advocates – the current legislation would freeze current inequities in perpetuity as a sop to wealthy school districts.

“What’s the difference between this and our current system, anyway?” Boltz asked.

But many in Harrisburg, including some officially in favor of the legislation, expressed concerns about the unforeseeable repercussions of SB 76.

“I think it could potentially pass this year,” said Drew Crompton, chief of staff to SB 76 supporter Senate President Pro Tempore Joe Scarnati. “What happens after that? I’m out. I don’t know. I don’t think anyone knows.”

If there is one thing everyone seems to agree on, it’s that Pennsylvania has a big problem with property tax inflation. But it’s a problem that is more acute in certain parts of the state, particularly in places where population has increased while incomes have stagnated.

While Pennsylvania’s population has remained relatively flat, places like Berks County and Monroe County saw explosive growth during the housing bubble. The latter saw its population jump 30 percent between 2000 and 2010. Today home to some of the most tax-burdened school districts in the country, millage rates across Monroe County doubled while median incomes increased by just 26 percent.

For some homeowners, that means that 10 to 15 percent of their income is going solely to local property taxes.

“An income tax is connected to your ability to pay today, but your property tax is connected to something you may have been able to pay 20 or 30 years ago,” Argall said.

Monroe County in northeastern Pennsylvania is a worst-case scenario: Homeowners can pay anywhere from less than 1 percent to more than 2 percent of a home’s value in property taxes each year. The state’s average property tax rate is the 13th-highest effective rate nationally, according to the Tax Foundation.

But while rates may vary, virtually every school district in Pennsylvania has turned to successive property tax hikes to cope with skyrocketing pension, health care and special education costs. Pennsylvania spends $26.1 billion annually on education, but 55 percent of districts drew the majority of that funding from local taxes.

Jim Rodkey summarizes the problem in his view: “We’re throwing people out of their homes to help other people pay for their retirement.”

The notion of extreme waste by school boards and administrators also looms large with property tax abolitionists. Jim Rodkey points to “ghost teachers” as a cause, although in places like Philadelphia, this kind of inefficiency accounts for just .02 percent of annual spending, according to a report by NBC 10.

Baldinger cites other forms of lavish spending, like a $2 million synthetic turf upgrade at his local high school football stadium, in the Governor Mifflin School District. The contractor’s website proclaims, “The [Mifflin] Mustangs can rightly claim to be on a level playing field with some of the biggest names in sports.”

“Why does that matter, and at whose expense?” Baldinger wonders aloud.

These feelings of outrage are inflamed by the repetitive nature of increases – Baldinger said his own property tax bill has doubled to nearly $8,000 annually on a modest house in a Berks County suburb overlooking Reading.

Those steep tax bills and his own retirement drove him to form the PTCC in 2004. Over the years, through hundreds of barnstorming town hall meetings, an aggressive online presence and a simple message, the septuagenarian gradually amassed nearly 87 allied political organizations and some 8,600 Facebook followers.

The PTCC Facebook page doubles as a sounding board for media coverage of SB 76 – bad and good – and as a repository for tales from thousands of homeowners who feel burdened by property taxes.

“My wife and I are looking to move out of PA,” reads one message from a commenter. “I can’t handle the taxes anymore. It’s a shame. We have lived here all our lives. But can not afford to live here anymore.”

An affiliated blog, the-disaffected.com, compiles dozens of similar testimonials and features a four-minute video explaining the key points of the proposed legislation, frequently referred to as the Property Tax Independence Act. The official PTCC website features a page titled, “Tips to Respond to Naysayers,” and an SB 76 tax savings calculator.

Baldinger credits these outreach efforts and the broad appeal of SB 76 with the growing, bipartisan popularity of his movement.

While the bill has bipartisan support, much of the movement’s growth has come through connections to conservative organizations. Baltz’s Pennsylvania Liberty Alliance is a product of the tea party movement and the Rodkeys’ Lebanon 9-12 Project is one of many similar groups inspired by right-wing commentator Glenn Beck.

While the PTCC downplays these affiliations and promotes the universality of the bill, some will find it hard to embrace the legislation as written because of its negative redistributive effects for many lower-income residents.

Baldinger frequently refers to the findings of a 2012 Independent Fiscal Office report on the potential impact of an older, but fundamentally similar version of SB 76 to validate his claims of a possible economic boom. The report also states that “retired homeowners would realize the largest relative tax cut and working-age renters would realize the largest relative tax increase.”

The report does predict an average 10 percent increase in property values along with possible employment growth and a reduction in operating costs for businesses with large landholdings, such as farms. Other positive side effects could include a $40 million to $80 million increase in corporate tax revenues and the realty transfer tax.

The PTCC includes its own summary of the positive findings online, and for good reason: The complete report is actually quite scathing. The first line of the report’s summary points to a projected $2.02 billion revenue shortfall two years after the enactment of SB 76 and the need for subsequent increases to the sales and income taxes.

Abolitionists say these fears are overblown – SB 76 allows for inflationary increases and the government would raise other taxes anyway – as are the negative impacts on the poor. Renters do pay for property taxes; it’s just included in their rent. Life will actually improve for renters, according to advocates, by staving off future rental increases related to property tax hikes – although this assumes that the law of supply and demand is the main driver of rising rents.

“Some people are going to see decreases in their rent,” Baldinger said. “Most landlords we’ve talked to said they would do the right thing. And fewer people will be renters in the long run because it will become more affordable to own a home under SB 76.”

But Nora Lichtash, lead organizer of The Philadelphia Coalition for Affordable Communities, spoke with her colleagues around the state about SB 76. While many were eager to see some reduction in property taxes, which are a legitimate housing pressure, all feared the current bill would do so by burdening vulnerable renters.

“We do not think landlords are going to pass through any of those savings to renters,” Lichtash said. “And coming from Philly, I don’t see our constituents being able to even get mortgages to buy a house. Even people at 100 percent of the city median income really struggle to get a mortgage … They are very far from being able to buy a home.”

Lichtash said that, in general, low-income renters are less able to deal with increases to the personal income tax or sales tax. Under SB 76, the sales tax would include new items and services, like hygiene products and day care, that are not currently taxed. While abolitionists frequently raise fears of homeowners losing their residences over unpaid taxes, in places like Philadelphia, the rental eviction rate is nearly six times higher than the foreclosure rate. Nearly half of all renters spend more than 30 percent of their income on rent.

“It’s true there are wealthy renters in Philly who live in places like Center City, but I think it is also true that most people who rent are poor or in working-class jobs,” Lichtash said. “The issue for me (with SB 76) is who’s paying – and who’s paying their fair share. Corporations and people who live in fancy houses probably should be paying their fair share in taxes.”

Baldinger likes to say that after 10 years of advocating for abolition, he has an answer for every critique of the bill. But he is sensitive to these particular kinds of statements, which he waves off as mere “class warfare.”

“Do I care if a guy in a million-dollar house gets a tax break if I don’t have to pay taxes?” he asks rhetorically.

The problem is that other people might. And the wealthy would likely see a big break: 70 percent of school tax is collected by the wealthiest half of school districts in the state. Because the bill provides an inflation-adjusted, dollar-for-dollar reimbursement of current education revenues – distributed out of a educational stabilization fund – the spending enjoyed by wealthier school districts would continue to be paid out of this fund by a wider base of taxpayers. A Pittsburgh renter making $50,000 today would see her income taxes jump by $1,000 under SB 76, in part to help maintain the largesse amassed by wealthy school districts in the Philadelphia suburbs.

This is one of several concessions Baldinger acknowledges were incorporated into the current bill to ease its passage. Although he privately hopes for full abolition someday, SB 76 leaves county property taxes in place, and school boards could technically use referendums to raise additional local revenues in the future.

The bill also exempts portions of school property taxes that fund a district’s debt service obligations. Reading, which Baldinger’s home overlooks, would likely see around 20 percent of its school property tax remain in place.

The Pennsylvania Association of School Business Officials, an extremely outspoken critic of the bill, said this undermines PTCC’s promises.

“We think so-called ‘property tax elimination’ is actually not property tax elimination,” PASBO Executive Director Jay Himes said. “In a good amount of districts, it’s not going to eliminate the schools portion entirely. In some districts, it will be minimal because they have high debt – places like big urban or small rural districts.”

But perhaps more damaging to PTCC’s assertions that SB 76 will provide an economic boon that outweighs its costs is opposition from the Pennsylvania Chamber of Business and Industry.

The last time the bill came up for a vote, Al Boscov, patriarch of the Reading-based Boscov’s department stores, submitted testimony against it. Citing “unanswered questions” about SB 76, the business organization generally favored decreasing PA’s corporate tax rate, the nation’s second highest.

While 25 percent of school funding comes from commercial landlords, most businesses and offices lease space or write down their real estate costs and many could end up paying higher salaries to compensate for increased income taxes.

Abolitionists describe the business chamber as dominated by corporate interests.

“It’s always the big chains that come out against us, but small businesses love us,” Jim Rodkey said.

However, it is far from a certainty that eliminating property taxes alone will right Pennsylvania’s flagging economy. Texas, a generally low-tax state with high property taxes, has little trouble attracting residents or businesses. West Virginia, meanwhile, struggles to kickstart job and population growth with one of the nation’s lowest property tax rates.

There is a tendency for PTCC members to dismiss some legitimate, bipartisan concerns about SB 76, particularly with an apparent victory tantalizingly close at hand. Nearly all opponents of the bill are often painted as self-interested elites or outright liars working “out of the same playbook.” Educational organizations are simply “self-serving special interest groups.” Anxious legislative aides are mostly “former lobbyists” working against the interests of the average voter. Business groups are shills for big corporations looking to protect specialized tax breaks.

But ideologically disparate groups oppose the bill, including the progressive Pennsylvania Budget and Policy Center and the conservative Americans for Prosperity.

The Commonwealth Foundation, a Harrisburg free-market think tank, articulated conservative fears about the bill, which spokeswoman Gina Diorio described as “merely a tax shift.”

“It doesn’t solve the problem of school spending, which will continue to cause taxes to rise unless addressed,” she said. “High property taxes are just a symptom.”

Asked how he interpreted resistance from conservative, liberal and even nonpartisan groups, like the IFO, Baldinger described a mixture of misinterpretation and outright lies.

Asked if there are any legitimate criticisms of the bill, Baldinger responded almost reflexively,“We haven’t found any yet.”

To be fair, staying on message against all odds is part of an activist’s job. But ultimately, frustrations with hyperlocal spikes in property taxes, broken school funding structures and intransigence in Harrisburg over how to deal with all these issues are as real as the flaws with SB 76.

To abolitionists, perhaps the strongest argument in favor of the bill is that it might actually stand a shot at passing in Harrisburg due to a fear among legislators of becoming “the reason you still pay property taxes.”

More nuanced property tax reforms – which notably lack zealous, grassroots supporters or a realistic statewide school funding plan – have been stalled for so long that advocates treat them like a punchline. In fact, abolitionists genuinely believe that simply passing SB 76 will create so much friction that it will finally force Harrisburg to confront many other problems. Legislators simply won’t have the option of punting on equitable education funding or pension reforms, for better or worse.

The advocates’ strongest argument in favor of a nuclear approach to property taxes is Harrisburg’s inability to pass literally any other, less drastic reform package. It’s taken so long, in fact, that an old man armed with a computer and an unwavering belief has succeeded in raising an army to back up his own radical solution to the problems state government has proved incapable of correcting.

“That’s just David – it’s like he’s in the room, even when he’s not in the room,” said Sue Rodkey, of Baldinger’s successes. “The state legislators could take a page from his book, if you ask me.” ■

NEXT STORY: Republicans cool to natural gas severance tax